It’s a familiar scene in boardrooms and conference halls: a passionate customer experience leader stands before a panel of executives, armed with spreadsheets and charts, trying to draw a straight, clean line from a CX initiative to a financial return on investment (ROI). This obsession with proving short-term CX ROI is a dangerous distraction. It’s not that CX doesn’t create immense value because it absolutely does. The problem is that our rigid, short-term ROI models are fundamentally unsuited for measuring it, creating a fantasy of control and precision where none exists.

The conventional approach to calculating CX ROI is riddled with flaws that lead to a distorted view of its true impact. By examining these flaws we can begin to understand why the relentless pursuit of a simple ROI figure is not only frustrating but also strategically misguided.

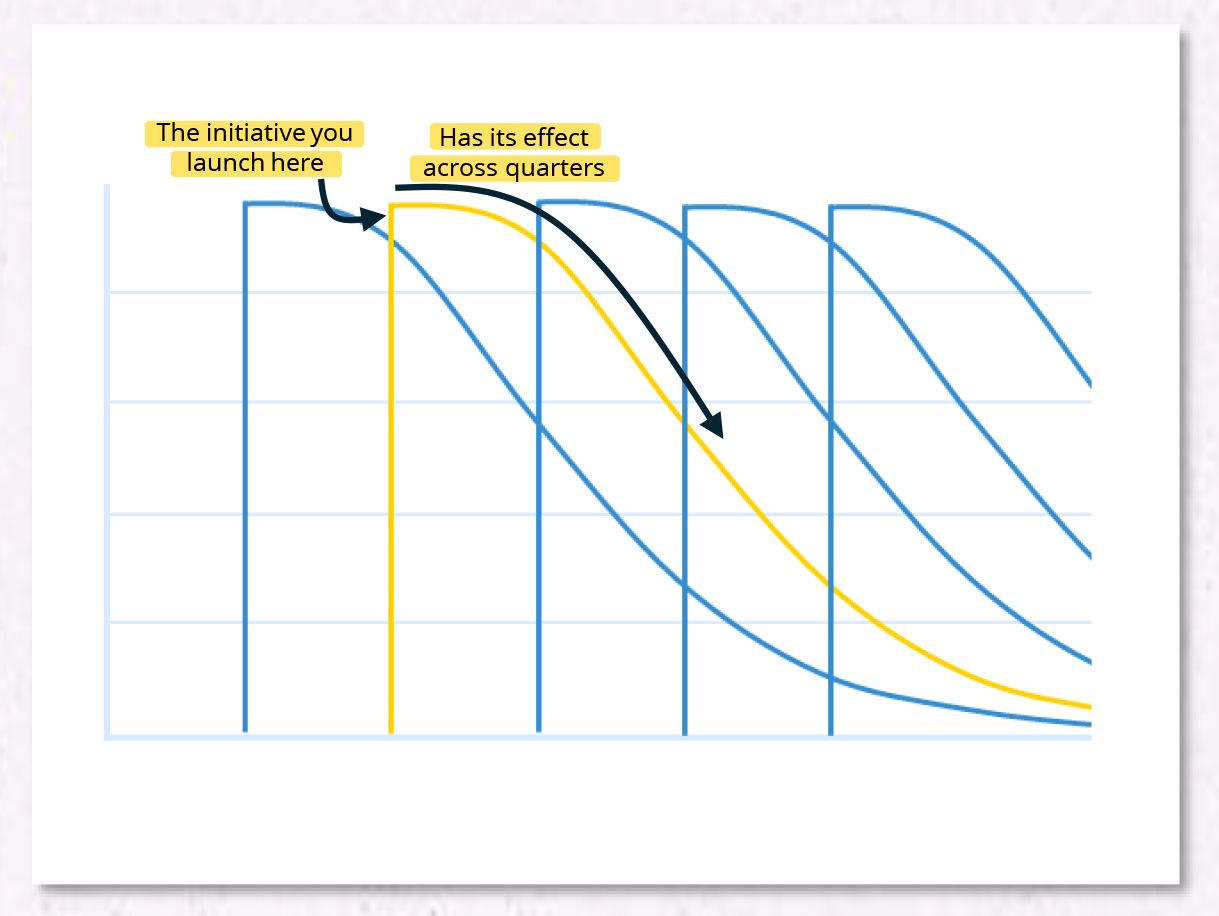

One of the most significant errors in traditional CX ROI calculations is the assumption that the value of a CX initiative will be fully realized within the same quarter it is implemented. A CX improvement made this quarter doesn't just affect this quarter's revenue. It spreads across multiple future periods. This concept, known as temporal lag, is a well-documented phenomenon.

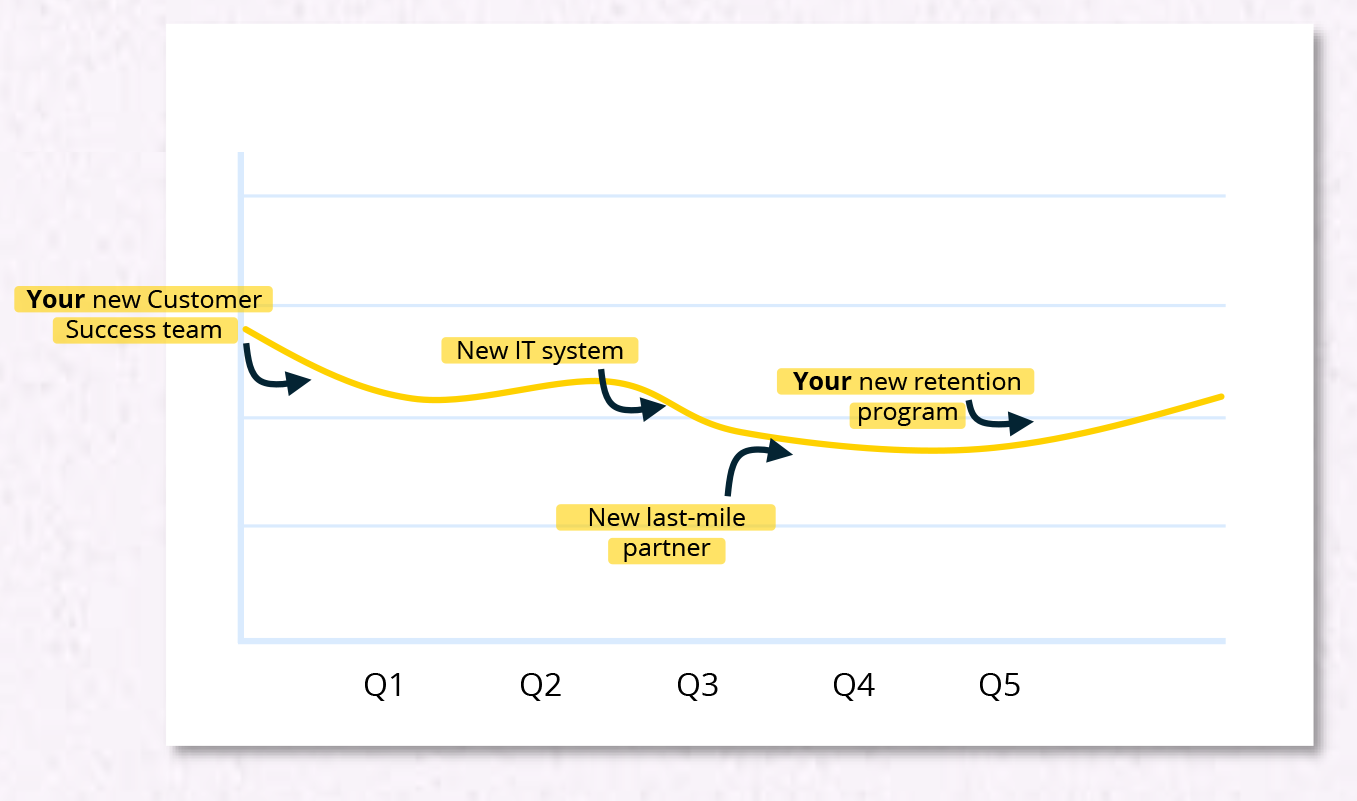

Figure 1: initiatives launched in one quarter have effects over multiple consecutive quarters

A 2020 study of nine Scandinavian banks found that customer satisfaction had a significant, positive influence on a bank's profitability, but this effect was not immediate. The researchers discovered that the customer satisfaction index of the preceding year was a strong predictor of the next year's financial performance(1).

In other words, the positive experiences customers had in one year translated into increased profitability and higher market value in the following year. This lag exists because the benefits of CX; such as increased loyalty, repeat purchases, and positive word-of-mouth, take time to accumulate and translate into measurable financial outcomes.

Another study further reinforces this point, identifying significant time lags between operational investments (such as company-wide staff training or new technology) and employee satisfaction, as well as between customer satisfaction and operating profit(2). The researchers warn that a myopic focus on short-term results can lead managers to make suboptimal decisions, as they may prematurely abandon valuable initiatives simply because the returns are not immediately apparent.

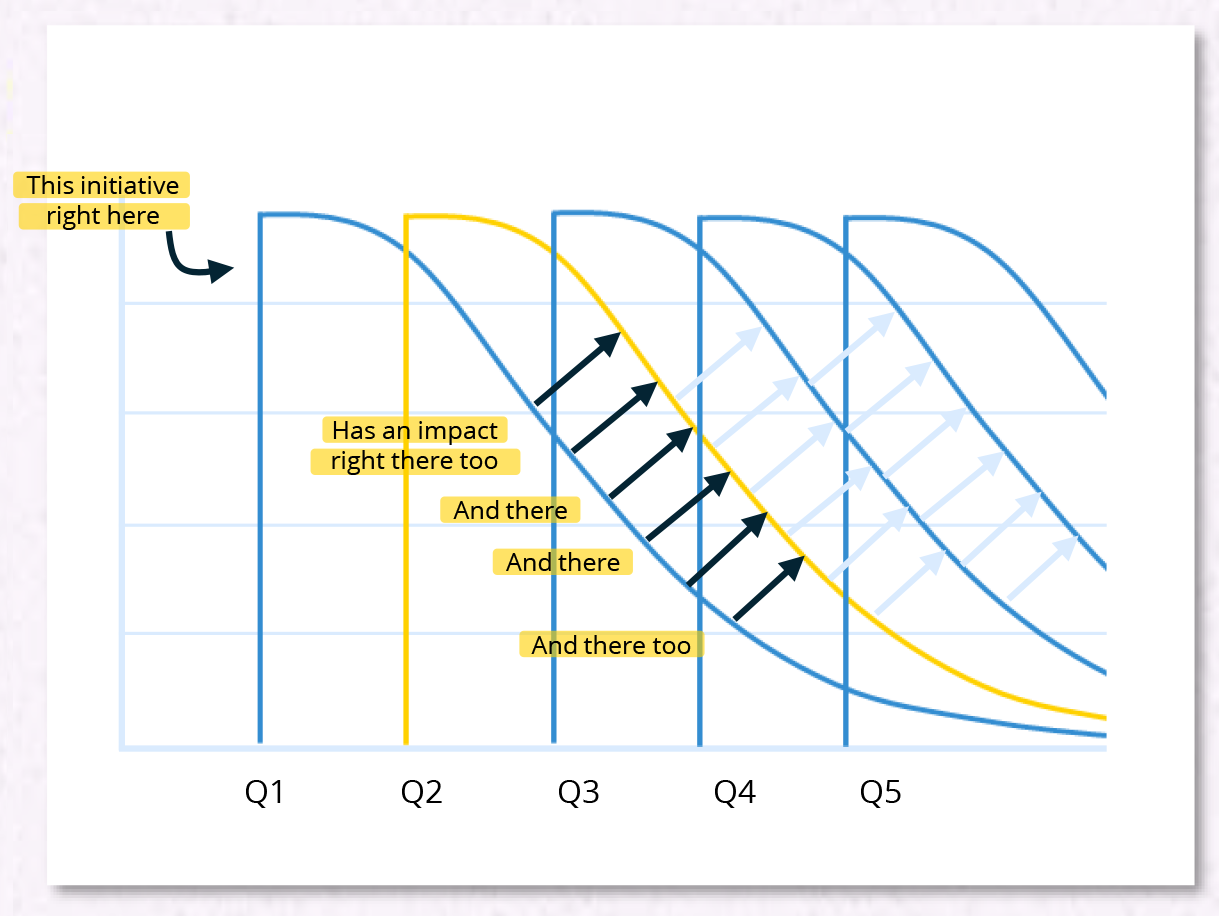

Just as the impact of today's CX efforts will be felt in the future, today's financial results are often a reflection of past investments.

A customer renewing a contract today may be doing so because of exceptional support they received six months ago. This creates a significant attribution challenge.

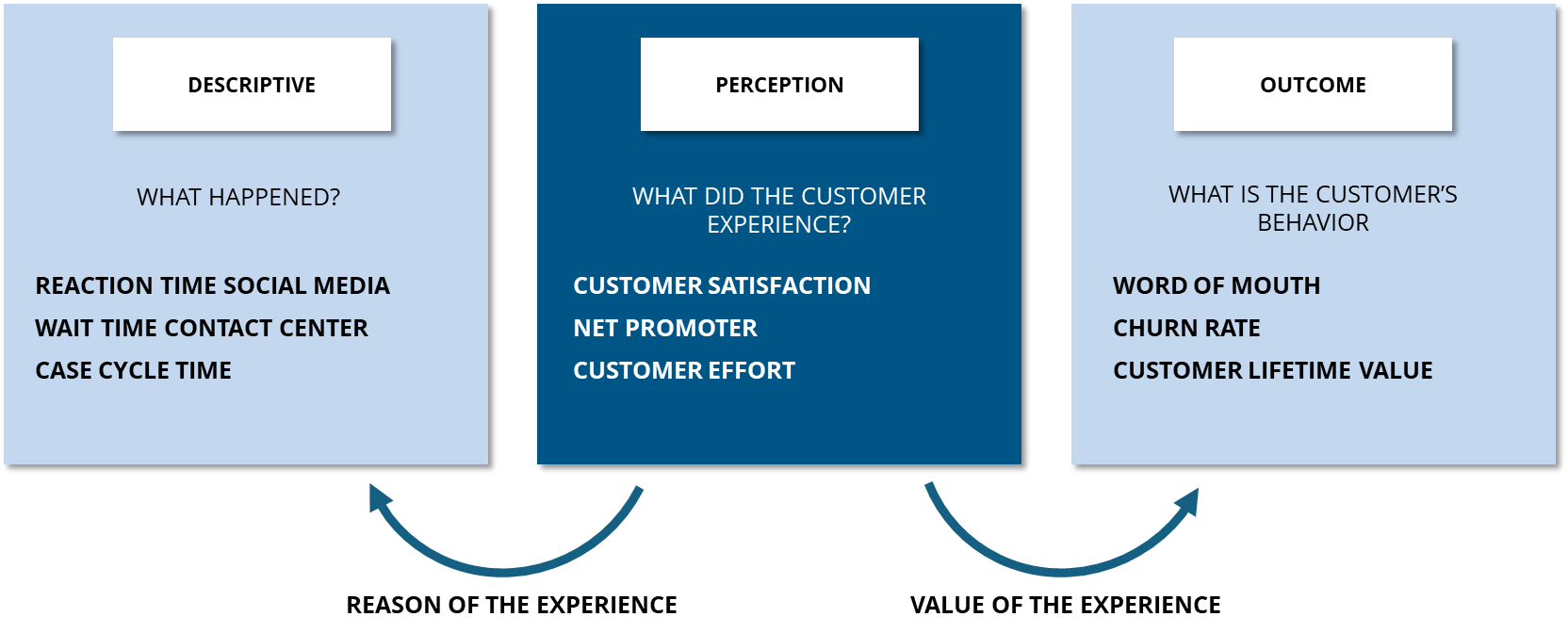

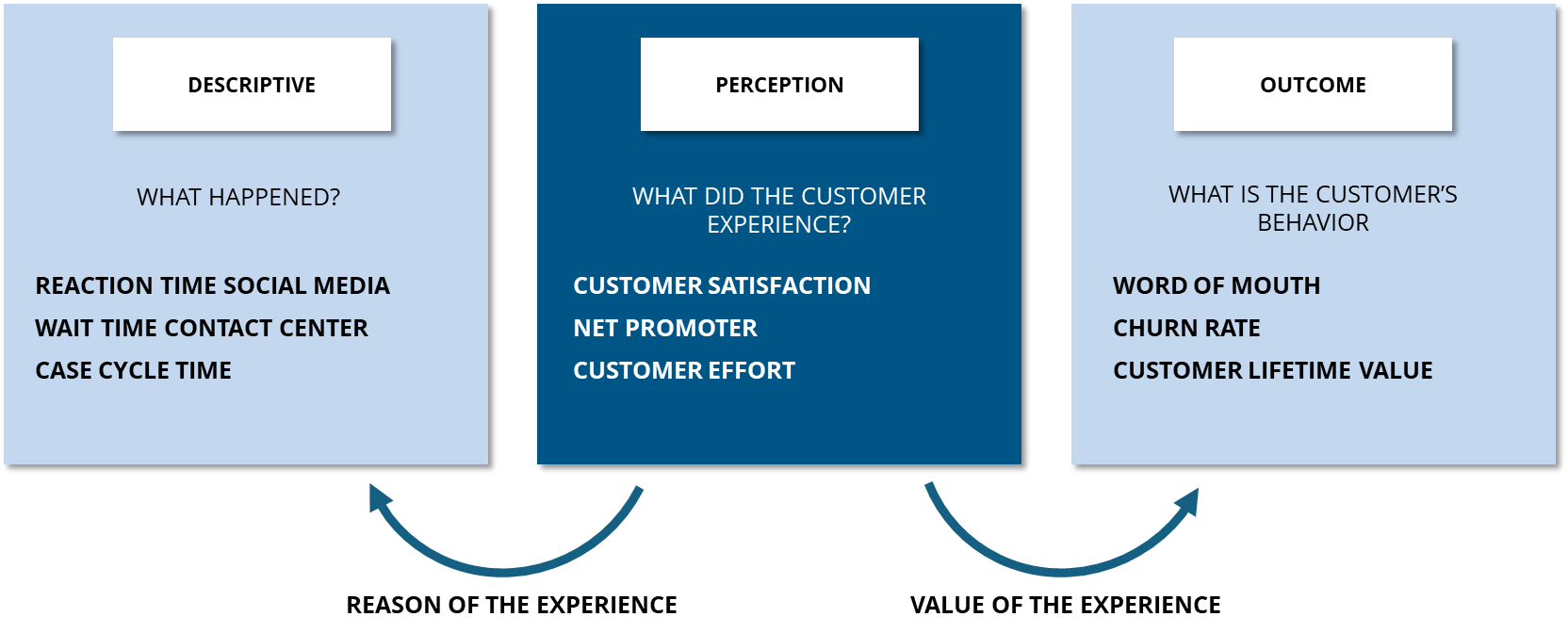

Our research-backed(3) framework helps visualize this challenge. We distinguish (unobservable) customer perception metrics,

Figure 2: Effects of initiatives in the past will keep on adding to the current and future experiences

like satisfaction and perceived quality, from (observable) behavioral outcomes metrics (like purchase frequency and customer retention). A company's marketing and CX actions influence what customers think and feel, which in turn drives what they do. This entire process unfolds over time, making it incredibly difficult to attribute a specific sale or renewal to a single touchpoint. Instead, it is the cumulative effect of many experiences that solidifies a customer's relationship with a brand.

Figure 3: Our research-backed Customer Experience Value Chain.

The Customer Experience Value Chain model also highlights the presence of complex feedback loops that complicate attribution.

For example, higher profits may lead a company to invest more in employee training, which boosts employee satisfaction, leading to better customer service, which then increases customer satisfaction and, eventually, future profits(2). In such a system, trying to isolate the ROI of a single initiative is a futile exercise. It’s like trying to credit a single raindrop for the growth of a forest.

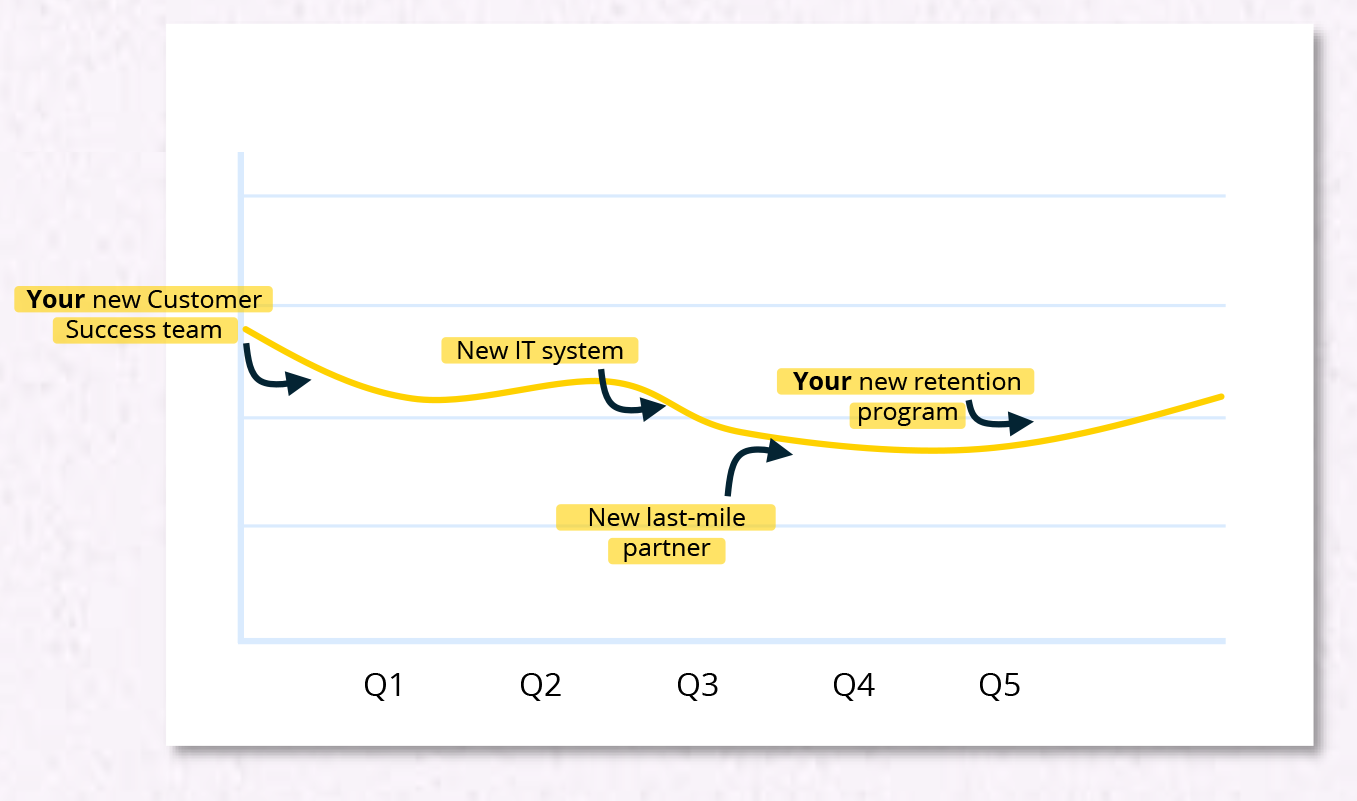

The third critical flaw in many CX ROI calculations is the failure to account for the baseline. As not all your revenue is impacted by your CX initiatives. Some customers would have stayed with you anyway. Calculating ROI against total revenue, rather than the incremental lift generated by a CX program, dramatically overstates its contribution.

Figure 4: Initiatives from other parts of the organization will also influence your results.

This is where the concept of myopic management becomes particularly dangerous. When managers are under pressure to demonstrate a high ROI, they may be tempted to use flawed calculations that produce an impressive but misleading number.

This creates a distorted picture of the firm's performance and can lead to poor strategic decisions. The authors of the Journal of Retailing study warn that relying on metrics that do not account for temporal effects and feedback loops can be actively misleading(2).

For example, if a company's revenue grew by €5 million in a quarter after launching a €1 million CX initiative, it is incorrect to claim a 400% ROI. A portion of that growth would have occurred regardless. The true ROI can only be calculated on the marginal revenue that was directly attributable to the CX program; a figure that is notoriously difficult to isolate.

The conventional, short-term approach to measuring CX ROI is not working. It ignores the long-term, cumulative, and complex nature of how customer experience creates value. So, what is the alternative? The solution is not to abandon measurement, but to adopt a more sophisticated and patient mindset.

Instead of chasing a single, all-encompassing ROI figure, organizations should focus on a balanced scorecard of metrics that includes both leading and lagging indicators. We are strong advocates of a deep understanding the outcome metrics, such as churn rates, upsell percentages, customer lifetime value; but also the operational metrics (depending on the type of interaction. For customer service this could be wait time, for marketing this could be click-through rates, for operations this could be adoption rates) that form the perception of the customer (NPS, CSAT, etc).

The goal should be to track the correlation between these indicators over time. By demonstrating that improvements in operational metrics are consistently followed by improvements in perception and thus outcome metrics; even with a time lag of several quarters, CX leaders can make a far more credible and robust case for their investments.

Ultimately, the most successful companies are those that recognize that treating customers well is not just a cost center to be justified, but a fundamental driver of sustainable, long-term growth.

But perhaps it's time to stop trying to "prove" the value of treating customers well and start focussing on actually doing it.

(1) Eklof, J., Podkorytova, O., & Malova, A. (2020). Linking customer satisfaction with financial performance: an empirical study of Scandinavian banks. Total Quality Management & Business Excellence, 31(15-16), 1684–1702.

https://www.tandfonline.com/doi/full/10.1080/14783363.2018.1504621(2) Evanschitzky, H., Wangenheim, F. V., & Wünderlich, N. V. (2012). Perils of Managing the Service Profit Chain: The Role of Time Lags and Feedback Loops. Journal of Retailing, 88(3), 356–366.

https://www.sciencedirect.com/science/article/abs/pii/S0022435912000048?via%3Dihub(3) Gupta, S., & Zeithaml, V. (2006). Customer Metrics and Their Impact on Financial Performance. Marketing Science, 25(6), 718-739.